In today’s ever-changing economic landscape, the value of assets such as your home, garage, and other property can fluctuate significantly over time. While it’s crucial to secure insurance coverage to safeguard against unforeseen events, many homeowners overlook a vital aspect: adjusting their policies to account for inflation.

1. Understanding Inflation’s Impact: Inflation is the gradual increase in the price of goods and services over time, resulting in a decrease in the purchasing power of currency. As inflation erodes the value of money, it also affects the cost of replacing or repairing your assets in the event of damage or loss. Failure to adjust insurance coverage for inflation means that the coverage amount may fall short of the actual replacement or repair costs.

2. Protecting Your Home: Your home is likely one of your most significant investments, and it’s essential to ensure that it is adequately insured against potential risks. Over time, the cost of labor and materials for home construction and repairs tends to rise due to inflation. Therefore, the coverage amount specified in your insurance policy should be periodically reviewed and adjusted to reflect the current replacement cost of your home.

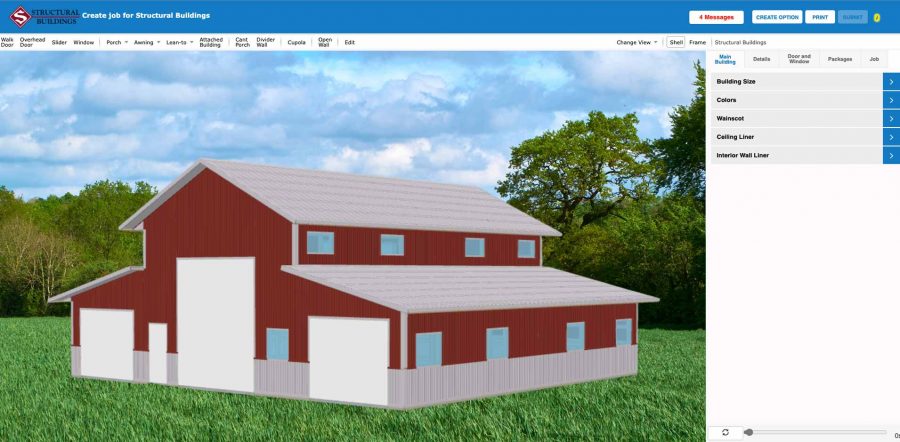

3. Garage and Other Assets: In addition to your home, it’s essential to consider other structures on your property, such as garages, sheds, and fences, when assessing your insurance needs. These structures are also susceptible to damage from various perils, and their replacement or repair costs can increase over time due to inflation. By adjusting your insurance policies to account for inflation, you can ensure adequate coverage for all your assets.

4. Avoiding Underinsurance: One of the most significant risks of failing to adjust insurance policies for inflation is the potential for underinsurance. If the coverage amount specified in your policy does not keep pace with inflation, you may find yourself unable to fully rebuild or repair your property in the event of a covered loss. This can lead to financial hardship and delays in restoring your home and assets to their pre-loss condition.

5. Regular Policy Reviews: To ensure that your insurance coverage remains adequate over time, it’s crucial to conduct regular reviews of your policies and make adjustments as needed. Consider consulting with your insurance agent or broker to assess your coverage needs and determine whether any updates are necessary to account for inflation and changes in the value of your assets.

6. Peace of Mind: By proactively adjusting your insurance policies to consider inflation, you can enjoy greater peace of mind knowing that you are adequately protected against unforeseen events. With the right coverage in place, you can focus on enjoying your home and property without worrying about the financial consequences of potential disasters.